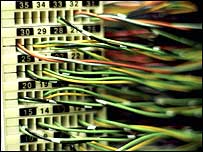

With all of these moves towards digital delivery in entertainment, we thought it would be worthwhile understanding one of the key items in this process – how to get the digital content to UK households.

Steve Kennedy is an acknowledged expert in the telecoms and data networks field, so it was an obvious choice for us to ask him to write an overview of how other IP operators can compete with BT – by creating their own data network. To do this, they need to put their own equipment into the telephone exchanges that connect to peoples houses. That process is Local Loop Unbundling (LLU).

Over three days we’ll give you a full background in LLU in the UK.

Yesterdays piece gave an overview of LLU and which companies are players in the UK.

LLU Penetration

All the large operators are going into around 1,000 DLEs (those being the most densely populated), since there are only around 1,200 of them, all the operators are targeting the same DLEs and there’s a lot of overlap.

Since the operators all want to get into the same exchanges, there’s overcrowding and BT have to install new hostel space (the space where operators can put their own equipment into) which causes delays. It can take more than 6 months from when an operator puts an order in to being granted access to an exchange.

Since the operators all want to get into the same exchanges, there’s overcrowding and BT have to install new hostel space (the space where operators can put their own equipment into) which causes delays. It can take more than 6 months from when an operator puts an order in to being granted access to an exchange.

LLU (un)Economics

When LLU was announced it was prohibitively expensive, mainly due to Ofcom (or Oftel as it was then) allowing BT to set the pricing models.

Over time the economics have become fairer to operators, with BT being forced to set-up BT Openreach which looks after the physical infrastructure. If they hadn’t formed Openreach, it’s likely Ofcom would have pushed for a split of BT.

Ofcom then made BT not reduce wholesale pricing for their broadband services to give LLU operators a chance to gain a foothold. BT would have to maintain their pricing until April 2007 or 1.5m unbundled lines, whichever came first.

In Dec 2006 there were 1,000,000 unbundled lines and last week Ofcom announced that 1,700,000 unbundled lines had been reached (there was no distinction between Option 2 and 4). BT Wholesale has over 9m broadband customers.

Also Carphone Warehouse (CPW) released their interim results showing they had 2.31m broadband customers, 700,000 utilising LLU.

So out of the 1.7m unbundled lines, CPW have .7m which means there’s 1m split between the rest (mainly the big players, Wanadoo, C&W, Easynet Pipex and Tiscali).

As a rough model that’s 1.7m lines, spread over 1,000 DLEs which makes 1,700 lines unbundled per DLE. There’s 6 big players which means around 280 customers per operator per exchange.

Unfortunately the economics of LLU only work if there’s a lot of customers per exchange i.e. massive scale.

Unfortunately the economics of LLU only work if there’s a lot of customers per exchange i.e. massive scale.

Now that the milestone of 1.5m unbundled lines has been reached, BT Wholesale will be allowed to reduce their pricing (which they’ve said they want to do) which will make the economics even worse.

To get the scale, further consolidation will occur which means fewer LLU operators in the future (Pipex has already put itself up for sale with CPW rumoured to be the front-runner for buying them). They need to do this in order to get the customer penetration per exchange.

The next and final section will cover the possibility of competition to BT and what could happen in the future

Images are courtesy of wb-internet and the BBC, respectively.

Last week, MusicTank held a panel discussion “The F Word: Monetising Filesharing”.

Last week, MusicTank held a panel discussion “The F Word: Monetising Filesharing”. This is the concluding part of the review of the

This is the concluding part of the review of the  Sonos like several other companies make music streaming systems. The BU130 consists of a controller and two ZP80 players all packaged into a single large’ish cardboard box. For the review, Sonos also supplied a docking cradle for the controller, which is an optional accessory, but it makes the whole system a lot neater in appearance.

Sonos like several other companies make music streaming systems. The BU130 consists of a controller and two ZP80 players all packaged into a single large’ish cardboard box. For the review, Sonos also supplied a docking cradle for the controller, which is an optional accessory, but it makes the whole system a lot neater in appearance. SMC have launched a business friendly Wi-Fi HotSpot in a box (SMCWHSG14-G).

SMC have launched a business friendly Wi-Fi HotSpot in a box (SMCWHSG14-G). The Audioblob2 is a 2.1 stereo system i.e. two satellites and a big subwoofer which also contains the amplifier and external connections.

The Audioblob2 is a 2.1 stereo system i.e. two satellites and a big subwoofer which also contains the amplifier and external connections. The subwoofer is finished in a very dark gloss, which means dust becomes very noticeable pretty quickly. It seems relatively resistant to scuffs.

The subwoofer is finished in a very dark gloss, which means dust becomes very noticeable pretty quickly. It seems relatively resistant to scuffs. Microsoft have actually made a sensible decision, an external HD DVD drive for the Xbox 360 and it works.

Microsoft have actually made a sensible decision, an external HD DVD drive for the Xbox 360 and it works. The new software works with all the Miglia decoders and offers similar functionality to EyeTV.

The new software works with all the Miglia decoders and offers similar functionality to EyeTV. The software also works directly with iTunes so stored video will appear on any connected AppleTVs.

The software also works directly with iTunes so stored video will appear on any connected AppleTVs. Also a single network would have meant it could go to many more of the 5,600 DLEs than the 1,200 everyone’s competing for at the moment.

Also a single network would have meant it could go to many more of the 5,600 DLEs than the 1,200 everyone’s competing for at the moment. Since the operators all want to get into the same exchanges, there’s overcrowding and BT have to install new hostel space (the space where operators can put their own equipment into) which causes delays. It can take more than 6 months from when an operator puts an order in to being granted access to an exchange.

Since the operators all want to get into the same exchanges, there’s overcrowding and BT have to install new hostel space (the space where operators can put their own equipment into) which causes delays. It can take more than 6 months from when an operator puts an order in to being granted access to an exchange. Unfortunately the economics of LLU only work if there’s a lot of customers per exchange i.e. massive scale.

Unfortunately the economics of LLU only work if there’s a lot of customers per exchange i.e. massive scale. What is Local Loop Unbundling (LLU)?

What is Local Loop Unbundling (LLU)? Any operator wanting to offer broadband (and possibly voice) has to put their equipment in these DLEs. However there is a cost to unbundling an exchange (around 100,000 including backhaul) which means operators are only targeting the most densely populated ones.

Any operator wanting to offer broadband (and possibly voice) has to put their equipment in these DLEs. However there is a cost to unbundling an exchange (around 100,000 including backhaul) which means operators are only targeting the most densely populated ones.