UK banks may be gleefully reporting big fat profits every quarter, but new research from eService provider Transversal claims that online customer service from Britain’s banks has sunk to an all time low.

UK banks may be gleefully reporting big fat profits every quarter, but new research from eService provider Transversal claims that online customer service from Britain’s banks has sunk to an all time low.

Their study found that fifty per cent of the major banks surveyed were so rubbish that they were unable to answer a single one of ten basic customer questions asked via their websites (these questions were based on typical customer enquiries about credit card offers, borrowing and mortgages etc).

A minority of banks, however, achieved excellent results, revealing the growing gulf between the best and worst performing banks.

Taken as a whole, the sector registered a lamentable average of 2.5 out of ten, managing to answer just 25 per cent of common questions.

Although this looks like an utterly abysmal score, things have actually got worse over the past year, with only two banks scoring nul points in 2005, and the sector mustering up a mighty average of three questions answered.

Despite 56 per cent of Brits now using online banking, these results suggest that banks are more interested in increasing profits by closing down High Street stores than serving their customers, with further cost-cutting measures seeing call centres shunted offshore into unknown foreign lands, often increasing customers’ frustration.

No email contacts for customers

As if to wind up their customers further, sixty per cent of bank websites didn’t allow consumers to contact them via email, forcing them to ring up and face the horrors of ‘on hold’ phone music.

Of the forty per cent that bothered to provide an email address, there was clearly no rush to answer their customers’ questions, with the banks taking a leisurely average of 22 hours to respond.

Of the forty per cent that bothered to provide an email address, there was clearly no rush to answer their customers’ questions, with the banks taking a leisurely average of 22 hours to respond.

The fastest response was a still-casual 8 hours – a whole working day – while the slowest was a massive 69 hours: enough time, the report noted, for the beleaguered customer to hop on a plane and travel to the offshore centre to ask the question personally.

The study also noted that only half of the major banks troubled themselves to provide a Frequently Asked Question (FAQ) page, and in many cases these were lurking in dark corners of the site, and not clearly marked for users.

A summary of the overall 2006 average banking results is as follows:

Average number of questions answered online: 2.5 out of 10 (2005 findings: 3)

Percentage of companies that responded to email correctly: 40% (2005 findings: 55%

Average email response time: 22 hours (2005 findings: 17 hours)

Percentage with customer FAQ pages: 50% (2005 findings: 60%)

Percentage with customer search: 60% (2005 findings: 40%)

UK regulator Ofcom is looking at plans to introduce high speed Internet access to broadband-starved remote areas by boosting the power of Wi-Fi signals.

UK regulator Ofcom is looking at plans to introduce high speed Internet access to broadband-starved remote areas by boosting the power of Wi-Fi signals. City networks

City networks Ruckus, who are currently working with Google to test a free mesh network in Mountain View, California, have developed a new Wi-Fi antenna to help home users connect to city networks.

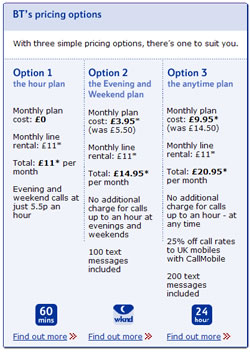

Ruckus, who are currently working with Google to test a free mesh network in Mountain View, California, have developed a new Wi-Fi antenna to help home users connect to city networks. As of today BT is reshuffling its phone pricing structure. In a typical move of a power-crazed ex-monopoly, it’s giving with one hand and taking away with another.

As of today BT is reshuffling its phone pricing structure. In a typical move of a power-crazed ex-monopoly, it’s giving with one hand and taking away with another. The ‘taking’

The ‘taking’ Well they got there finally, Vodafone UK have announced that they’re releasing the less than catchy named Vodafone Mobile Connect USB Modem in the Autumn. It will support their 3G data service and, surprise, surprise, connect to computers using a USB lead. Rather neatly the software disks aren’t needed, as they’re installed directly from the modem.

Well they got there finally, Vodafone UK have announced that they’re releasing the less than catchy named Vodafone Mobile Connect USB Modem in the Autumn. It will support their 3G data service and, surprise, surprise, connect to computers using a USB lead. Rather neatly the software disks aren’t needed, as they’re installed directly from the modem. BSkyB results for the last year were broadly in line with predictions, but seasoned watchers of all things financial, recognise tell-tale signs of a flattening of the growth curve. The company has managed its spend on programming well, but technology costs remain high, with significant outgoings on expensive High Definition equipment, that won’t bring instant revenue returns.

BSkyB results for the last year were broadly in line with predictions, but seasoned watchers of all things financial, recognise tell-tale signs of a flattening of the growth curve. The company has managed its spend on programming well, but technology costs remain high, with significant outgoings on expensive High Definition equipment, that won’t bring instant revenue returns. James Murdoch the CEO of BSkyB told the corporate world that “Our industry is changing faster than ever before and for Sky, 2006 has been an important and exciting year.”

James Murdoch the CEO of BSkyB told the corporate world that “Our industry is changing faster than ever before and for Sky, 2006 has been an important and exciting year.” In the largest UK study of its kind, the Mobile Life Report has revealed our attitudes towards mobile phones and how they have impacted on our lives, with more than 90% of UK mobile users saying they can’t get through the day without using their phone.

In the largest UK study of its kind, the Mobile Life Report has revealed our attitudes towards mobile phones and how they have impacted on our lives, with more than 90% of UK mobile users saying they can’t get through the day without using their phone. Lord knows why people bothered to answer these questions, but the survey found that a quarter of people bothered to disconnect their mobiles before indulging in a bit of hanky panky, with 11% switching them to silent (writer resists cheap joke about vibra-alerts) and 14% turning their phones off altogether.

Lord knows why people bothered to answer these questions, but the survey found that a quarter of people bothered to disconnect their mobiles before indulging in a bit of hanky panky, with 11% switching them to silent (writer resists cheap joke about vibra-alerts) and 14% turning their phones off altogether. Following the surprise resignation of SMG’s Chief executive Andrew Flanagan, the pieces are in place for consolidation of the Scottish and Ulster media outfits that provide the Celts with their ITV services.

Following the surprise resignation of SMG’s Chief executive Andrew Flanagan, the pieces are in place for consolidation of the Scottish and Ulster media outfits that provide the Celts with their ITV services. With many predicting the imminent departure of Charles Allen, ITV, a shareholder in SMG has troubles enough of it’s own to be ruled out of a takeover.

With many predicting the imminent departure of Charles Allen, ITV, a shareholder in SMG has troubles enough of it’s own to be ruled out of a takeover. Today it was announced that Whitehaven, Cumbria will be the first area in England to have its TV reception changed over from analog to digital.

Today it was announced that Whitehaven, Cumbria will be the first area in England to have its TV reception changed over from analog to digital. Yesterday saw the press unveiling of Sky Broadband, showing the eventual absorption of EasyNet, the UK ISP that they

Yesterday saw the press unveiling of Sky Broadband, showing the eventual absorption of EasyNet, the UK ISP that they  Sky marketing have been taking their now-expected simplistic approach to the name of the product, with Base, Mid and Max. It’s genius like this that produced the name Sky+, the name that sold 100k+ PVRs to the UK public, when previously they didn’t understand what the hell it was.

Sky marketing have been taking their now-expected simplistic approach to the name of the product, with Base, Mid and Max. It’s genius like this that produced the name Sky+, the name that sold 100k+ PVRs to the UK public, when previously they didn’t understand what the hell it was. Since James Murdoch took over running Sky, its stated ambition has been 10 million subscribers by 2010, but as we get closer to that, it’s getting hard to convert over those naughty-non-subscribers.

Since James Murdoch took over running Sky, its stated ambition has been 10 million subscribers by 2010, but as we get closer to that, it’s getting hard to convert over those naughty-non-subscribers. As expected, Sky has released details of their new “free” broadband promotion, which offers their 2Mb Base package for nowt.

As expected, Sky has released details of their new “free” broadband promotion, which offers their 2Mb Base package for nowt. For users out of a Sky network area, there’s the pricey ‘Connect’ option which offers up to 8Mbs connectivity, 40GB usage cap, £40 activation fee and £50 home install for a distinctly upmarket £17 per month.

For users out of a Sky network area, there’s the pricey ‘Connect’ option which offers up to 8Mbs connectivity, 40GB usage cap, £40 activation fee and £50 home install for a distinctly upmarket £17 per month. 30 per cent of Sky customers on broadband

30 per cent of Sky customers on broadband