A few week back, BT confirmed that they have closely tied themselves with US podcast aggregator, PodShow, so closely in fact, that they’ve stuck BT at the front of PodShow domain to form BTPodShow.

A few week back, BT confirmed that they have closely tied themselves with US podcast aggregator, PodShow, so closely in fact, that they’ve stuck BT at the front of PodShow domain to form BTPodShow.

We were at the launch of the service a few weeks ago and chatted to Gavin Patterson, group managing director, consumer division and group marketing, BT; Adam Curry, President and Co-founder, PodShow and Ron Bloom, CEO and Co-founder, PodShow. Strangely for the launch of a podcast network, we were the only ones there recording interviews.

Looking for the podcast interviews? They’ll be available in part two tomorrow.

Rather than just rattle off the news, we felt it was worthwhile digging a bit deeper and understand the How and Why of the deal.

What makes this interesting?

Quite a few reasons really. Not the least being that, showing a change of approach, BT aren’t making the service exclusive to only their network – their normal approach to try and encourage people to subscribe to their DSL service. BTPodShow will in fact be open to anyone in the UK.

This alone shows a major shift within BT that shouldn’t be underestimated. It demonstrates an understanding that, although they dominate broadband provision in the UK (with nearly 3m accounts of their own, without all of the BT Wholesale lines sold via other UK broadband providers), they can’t own the whole market.

Having acknowledged this, they’ve clearly decided that they just as well make some income from the people who don’t buy broadband from them.

Where does the income come from?

Where does the income come from?

While the financials of the deals haven’t been disclosed. We understand that there will be a revenue share between the two parties, expected to mostly come from advertising income.

The PodShow side of the business is responsible for finding, maintaining and managing the relationships with the advertiser. At launch they reported that they had 40 global brands lined up to advertise on the network. If these are unique to the UK version, or are extension of relationship they already have with their previous site isn’t clear.

Why this deal. Why now? BTVision

We think a major reason is BT Vision, their soon to be launched ipTV service.

BT have recognised that the current fodder broadcast on TV, will not continue to satisfy the wants and desires of the public in the future. In the words of BT’s consumer division group managing director, Gavin Patterson’s words, “The trend to user-generated content, and social media networks is clear cut. We see ourselves as a distributor of content. What we anticipate is more people wanting get involved with creating content.”

To fill the gap left by the dissatisfaction with ‘normal TV’, they have to open a collection channel for the content to flow to them and then build a collection of User Generated Content (UCG). While they could build PodShow’s technology themselves, it’s clear that BT don’t want to miss out on this, wanting to get into this area quickly, as confirmed by the speed at which they put this deal together.

We wondered if the higher resolution video might not be put out on the Website, but reserved for BTVision, to which Patterson said, “The experience that people have over the Internet will not be sufficient for the TV space. I anticipate it will happen.”

We wondered if the higher resolution video might not be put out on the Website, but reserved for BTVision, to which Patterson said, “The experience that people have over the Internet will not be sufficient for the TV space. I anticipate it will happen.”

The advantages for PodShow are obvious. If they export this idea to any other country, they’ll be able to hold BT up as their first partner, something that really can’t be beaten.

As BT have a near monopoly on broadband and land line provision in the UK they can expose BTPodShow to the 17m ‘customer relationships’ they have, not just to encourage people to go to BTPodShow to watch the content, where they’ll make income from advertising, but to encourage those same people to produce and upload content.

Moves like this cannot help but strengthen BT as a media brand in the mind of the public – especially the youth. Vital for their service growing in the future.

Continued in the concluding piece, covering the advantages for PodShow and the chances of success of the service.

European mobile phone users are far more likely to use their handsets to access the web than their US counterparts, according to a new comScore Networks study.

European mobile phone users are far more likely to use their handsets to access the web than their US counterparts, according to a new comScore Networks study. Portal sites were the most popular destinations for mobile surfers, with Google, Yahoo! and MSN leading the way, with branded Web sites set up by the phone operators, such as Vodafone, o2 and T-Mobile also proving a hit.

Portal sites were the most popular destinations for mobile surfers, with Google, Yahoo! and MSN leading the way, with branded Web sites set up by the phone operators, such as Vodafone, o2 and T-Mobile also proving a hit. Orb MyCasting has been grabbed by Nokia to be bundled in with the Nokia N80 Internet Edition, in the US only.

Orb MyCasting has been grabbed by Nokia to be bundled in with the Nokia N80 Internet Edition, in the US only. As we\\’d

As we\\’d

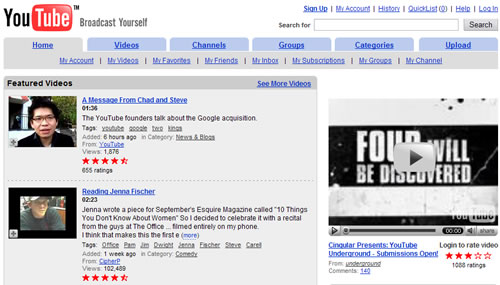

In true online video blog style, the announcement was made by Mr Diddy (not one of

In true online video blog style, the announcement was made by Mr Diddy (not one of  Details of the deal between Mr Diddy and Burger King haven’t been disclosed, but we’d imagine that it’s going to be worth more that a couple of orders at their stores, even if his entourage are ordering large.

Details of the deal between Mr Diddy and Burger King haven’t been disclosed, but we’d imagine that it’s going to be worth more that a couple of orders at their stores, even if his entourage are ordering large. We attribute much of Mr Diddy’s knowledge and acceptance of YouTube down to

We attribute much of Mr Diddy’s knowledge and acceptance of YouTube down to  A few week back, BT confirmed that they have closely tied themselves with US podcast aggregator, PodShow, so closely in fact, that they’ve stuck BT at the front of PodShow domain to form BTPodShow.

A few week back, BT confirmed that they have closely tied themselves with US podcast aggregator, PodShow, so closely in fact, that they’ve stuck BT at the front of PodShow domain to form BTPodShow. Where does the income come from?

Where does the income come from? We wondered if the higher resolution video might not be put out on the Website, but reserved for BTVision, to which Patterson said, “The experience that people have over the Internet will not be sufficient for the TV space. I anticipate it will happen.”

We wondered if the higher resolution video might not be put out on the Website, but reserved for BTVision, to which Patterson said, “The experience that people have over the Internet will not be sufficient for the TV space. I anticipate it will happen.” Millions of game-toughened poker faces are showing signs of impending blubbering as the US Congress unexpectedly passed anti-online gambling laws last week.

Millions of game-toughened poker faces are showing signs of impending blubbering as the US Congress unexpectedly passed anti-online gambling laws last week. The new laws will wipe out US revenue for London-based online-gaming companies, with PartyGaming saying that they’d suspend business with US residents as soon as the law takes effect.

The new laws will wipe out US revenue for London-based online-gaming companies, with PartyGaming saying that they’d suspend business with US residents as soon as the law takes effect. “After taking extensive legal advice, the Board of PartyGaming Plc has concluded that the new legislation, if signed into law, will make it practically impossible to provide US residents with access to its real money poker and other real money gaming sites. As a result of this development, the Board of PartyGaming has determined that if the President signs the Act into law, the Company will suspend all real money gaming business with US residents, and such suspension will continue indefinitely, subject to clarification of the interpretation and enforcement of US law and the impact on financial institutions of this and other related legislation.”

“After taking extensive legal advice, the Board of PartyGaming Plc has concluded that the new legislation, if signed into law, will make it practically impossible to provide US residents with access to its real money poker and other real money gaming sites. As a result of this development, the Board of PartyGaming has determined that if the President signs the Act into law, the Company will suspend all real money gaming business with US residents, and such suspension will continue indefinitely, subject to clarification of the interpretation and enforcement of US law and the impact on financial institutions of this and other related legislation.” Good news for UK Tech firm Pace Micro as it receives confirmation from number one US cable company, Comcast to ship combined Set Top Box (STB) and PVR.

Good news for UK Tech firm Pace Micro as it receives confirmation from number one US cable company, Comcast to ship combined Set Top Box (STB) and PVR. Comcast is mighty, being the largest provider of cable services in the US, with 23.3 million cable customers, 10 million high-speed Internet customers and 1.6 million voice customers. Their business extends beyond simple cable TV provision, in their own words, they’re “focused on broadband cable, commerce, and content.”

Comcast is mighty, being the largest provider of cable services in the US, with 23.3 million cable customers, 10 million high-speed Internet customers and 1.6 million voice customers. Their business extends beyond simple cable TV provision, in their own words, they’re “focused on broadband cable, commerce, and content.” U.S. Internet advertising revenue has hit a new record high of nearly $8 billion for first six months of the year, increasing by a money-spinning 37 per cent, according to a new study.

U.S. Internet advertising revenue has hit a new record high of nearly $8 billion for first six months of the year, increasing by a money-spinning 37 per cent, according to a new study. The IAB/ PricewaterhouseCoopers figures show that Internet advertising revenue totalled nearly $4.1 billion in the last quarter, representing a thumping a 36 percent increase over the same period last year, and up a healthy 5.5 percent over the first quarter of 2006.

The IAB/ PricewaterhouseCoopers figures show that Internet advertising revenue totalled nearly $4.1 billion in the last quarter, representing a thumping a 36 percent increase over the same period last year, and up a healthy 5.5 percent over the first quarter of 2006. In 2004 the networking giant Cisco sued a little-known Chinese company called Huawei for IP (Intellectual Property) theft. Some two months later the case was dropped and settled out of court. Huawei promised to modify their designs, change their software and manuals. Rumours circulating at the time alleged that the Chinese government got involved and told Cisco that if they wanted to operate in China, they should leave Huawei alone.

In 2004 the networking giant Cisco sued a little-known Chinese company called Huawei for IP (Intellectual Property) theft. Some two months later the case was dropped and settled out of court. Huawei promised to modify their designs, change their software and manuals. Rumours circulating at the time alleged that the Chinese government got involved and told Cisco that if they wanted to operate in China, they should leave Huawei alone. In China engineering talent is relatively cheap and their universities produce very high class students (and lots of them). This brings Huawei another advantage – huge manpower. When bugs are passed to Huawei, they go to their pool of, something like, 20,000 engineers, leading to the faults being tracked and fixed extremely quickly.

In China engineering talent is relatively cheap and their universities produce very high class students (and lots of them). This brings Huawei another advantage – huge manpower. When bugs are passed to Huawei, they go to their pool of, something like, 20,000 engineers, leading to the faults being tracked and fixed extremely quickly. According to new research from The Diffusion Group, only 14% of broadband households would be interested in an iTunes online movie download service for use on PCs or portable devices if titles were priced at $15 each. This compares to total interest of 23% at $10 per download – a 64% decline in interest when increasing the cost per title by only $5.

According to new research from The Diffusion Group, only 14% of broadband households would be interested in an iTunes online movie download service for use on PCs or portable devices if titles were priced at $15 each. This compares to total interest of 23% at $10 per download – a 64% decline in interest when increasing the cost per title by only $5. Regardless of whether the iTunes movie download service is announced this month or later this year, Greeson believes that the time is right for Apple to enter this market space. “Although current services such as CinemaNow and Movielink continue to languish, Apple is aware that the conditions are now suitable for extending iTunes to include full-length movie downloads. Consumer awareness has improved; video-over-broadband is now viable; studios are now making movies available for online download to DVDs; portable video platforms are improving qualitatively with each new generation; and Apple’s brand awareness and credibility are at all time highs. As well, CinemaNow and Movielink’s experience, while insightful, is of limited value to Apple, who continues to enjoy the fruits of being a market-maker in portable digital electronics and online media services.”

Regardless of whether the iTunes movie download service is announced this month or later this year, Greeson believes that the time is right for Apple to enter this market space. “Although current services such as CinemaNow and Movielink continue to languish, Apple is aware that the conditions are now suitable for extending iTunes to include full-length movie downloads. Consumer awareness has improved; video-over-broadband is now viable; studios are now making movies available for online download to DVDs; portable video platforms are improving qualitatively with each new generation; and Apple’s brand awareness and credibility are at all time highs. As well, CinemaNow and Movielink’s experience, while insightful, is of limited value to Apple, who continues to enjoy the fruits of being a market-maker in portable digital electronics and online media services.”