BT’s dominance of the UK home telephone is coming under fresh pressure as the phone call market becomes the most liberal in Europe. Previously, their pricing levels have had to be agreed in advance with the UK regulator Ofcom, but with it understood that this is going to be lifted soon, price cuts are expected.

BT’s dominance of the UK home telephone is coming under fresh pressure as the phone call market becomes the most liberal in Europe. Previously, their pricing levels have had to be agreed in advance with the UK regulator Ofcom, but with it understood that this is going to be lifted soon, price cuts are expected.

In a sign that the gloves are well and truly off, Tesco has unleashed a price-busting Voice over IP (VoIP) package designed to lure customers from the incumbent operator.

It’s further proof (if any were needed) that VoIP continues to shake things up in the voice phone market.

The Tesco package will be marketed at just under £20 and will include a ‘normal’ phone handset that plugs in to a broadband-enabled PC’s USB port, and the software need to drive it. Calls will be made at a fraction of the current cost.

Many other companies continue to pressure BT. Talk-Talk, the landline phone service by The Carphone Warehouse, has already consolidated two of the traditional landline competitors and it’s likely that Sky would also welcome call revenue via its recent Easynet acquisition.

Pressure is also coming from outside the UK. US giant AOL has BT in its sights with a programme to exploit the Local Loop Unbundling (LLU) agreement BT made with Ofcom, which permits AOL and others to house high tech Voice over IP equipment at exchanges throughout the country.

Technical-savvy Skype callers have for a long time taken advantage of VoIP calling to obtain free or cheap calls.

Technical-savvy Skype callers have for a long time taken advantage of VoIP calling to obtain free or cheap calls.

The danger for BT is that the trickle of the public away from its traditional services over recent years could become a torrent, as more content, including broadband TV starts to be delivered by IP, BT could lose their in-built advantage as the default delivery gateway to UK homes.

Is all of this price cutting good news for British consumers? Well, certainly lower call prices will benefit the majority of UK call makers, but there is a question mark in the long run. It could bring mixed blessings for the UK’s telecoms infrastructure as BT tries to cut costs and investment to ensure that its institutional shareholders remain happy as they operate on slimmer margins.

Speculators with a wad of cash might like to consider convert said cash into an ITV plc share holding in the next few days some feel.

Speculators with a wad of cash might like to consider convert said cash into an ITV plc share holding in the next few days some feel. Unlike Sky, which is principally a broadcast platform owner and call centre operator, ITV actually has what companies with desires to be fully-grown media giants badly need; content and a fifty year plus heritage of making TV programmes.

Unlike Sky, which is principally a broadcast platform owner and call centre operator, ITV actually has what companies with desires to be fully-grown media giants badly need; content and a fifty year plus heritage of making TV programmes. Interestingly, after

Interestingly, after  Mr Gates, speaking in the keynote address at the Consumer Electronics Show (CES) in Las Vegas, evangelised the “arrival of the much-trailed ‘digital lifestyle’” (which of course, we here at Digital Lifestyles just loved when

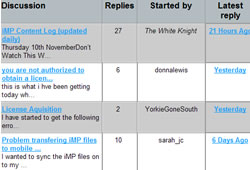

Mr Gates, speaking in the keynote address at the Consumer Electronics Show (CES) in Las Vegas, evangelised the “arrival of the much-trailed ‘digital lifestyle’” (which of course, we here at Digital Lifestyles just loved when  The BBC has decided to extend the trial for the iMP Player until 28th February 2006, telling trialists that the extra time will enable it to “understand what you want from the service and how you are using it”. A new upgrade of the software is due to be rolled out to the participating trialists in January.

The BBC has decided to extend the trial for the iMP Player until 28th February 2006, telling trialists that the extra time will enable it to “understand what you want from the service and how you are using it”. A new upgrade of the software is due to be rolled out to the participating trialists in January. The BBC’s reaction to such sniping is consistent, if not a little bland

The BBC’s reaction to such sniping is consistent, if not a little bland Separately, a consolidating Carphone Warehouse has been on the acquisition trail and agreed the purchase of Tele2’s UK and Ireland operations, and separately, Onetel.

Separately, a consolidating Carphone Warehouse has been on the acquisition trail and agreed the purchase of Tele2’s UK and Ireland operations, and separately, Onetel. The purchase of Onetel from Centrica for £132 million includes £37.1 million, while will be delivered if Centrica deliver a targeted number of customers in the next three years via its British Gas operations. The Carphone Warehouse will also pay Centrica an additional £22.2 million if higher sign-up targets are met.

The purchase of Onetel from Centrica for £132 million includes £37.1 million, while will be delivered if Centrica deliver a targeted number of customers in the next three years via its British Gas operations. The Carphone Warehouse will also pay Centrica an additional £22.2 million if higher sign-up targets are met. In the week that BT and Sky both saw their triple play offerings potentially trumped by a possible NTL/Virgin ‘quadruple play’, BT chose to release details of its upcoming content deals with BBC Worldwide, Paramount and Warner Music Group.

In the week that BT and Sky both saw their triple play offerings potentially trumped by a possible NTL/Virgin ‘quadruple play’, BT chose to release details of its upcoming content deals with BBC Worldwide, Paramount and Warner Music Group. Against a backdrop of whispered rumours of delays with Microsoft’s IPTV Edition, the BT service is slated for launch next year.

Against a backdrop of whispered rumours of delays with Microsoft’s IPTV Edition, the BT service is slated for launch next year. Takeover mania isn’t confined to one side of the Atlantic; Liberty, the media group that includes QVC and holds a majority stake in IAC/Interactive Corp, is buying Provide Commerce whose mission is “To become the leading e-commerce marketplace for the delivery of perishable products direct from the supplier to the consumer,” whatever that means.

Takeover mania isn’t confined to one side of the Atlantic; Liberty, the media group that includes QVC and holds a majority stake in IAC/Interactive Corp, is buying Provide Commerce whose mission is “To become the leading e-commerce marketplace for the delivery of perishable products direct from the supplier to the consumer,” whatever that means. The Liberty purchase, is subject to approvals from US regulatory bodies as well as Provide Commerce shareholders, if all obstacles are cleared then the acquisition should complete in the second quarter of 2006.

The Liberty purchase, is subject to approvals from US regulatory bodies as well as Provide Commerce shareholders, if all obstacles are cleared then the acquisition should complete in the second quarter of 2006. Bill Strauss Provide Commerce’s CEO was equally direct,

Bill Strauss Provide Commerce’s CEO was equally direct, Friends Reunited and ITV have decided to make it legal; after a short romance, a deal’s been agreed. Rumours they’d been seeing other suitors that included BT, News Corp and that bastion of middle England the Daily Mail & General Trust, did little to cool the ardour of an excited ITV.

Friends Reunited and ITV have decided to make it legal; after a short romance, a deal’s been agreed. Rumours they’d been seeing other suitors that included BT, News Corp and that bastion of middle England the Daily Mail & General Trust, did little to cool the ardour of an excited ITV. “A powerful consolidated online advertising sales proposition. 53% of Friends Reunited users are in the ABC1 demographic and 40% are in the 16-34 age range – both key audiences for advertisers. It will contribute additional advertising synergies as ITV Internet sales will have increased scale, becoming a one-stop-shop for media agencies in the online space.”

“A powerful consolidated online advertising sales proposition. 53% of Friends Reunited users are in the ABC1 demographic and 40% are in the 16-34 age range – both key audiences for advertisers. It will contribute additional advertising synergies as ITV Internet sales will have increased scale, becoming a one-stop-shop for media agencies in the online space.” The words European and Commission, when used together rarely equate to clarity. This is holding true with the mixed signals on the financial support that will be permitted in the transition to Digital TV across Europe.

The words European and Commission, when used together rarely equate to clarity. This is holding true with the mixed signals on the financial support that will be permitted in the transition to Digital TV across Europe. The Commission made clear that it supports the transition to digital broadcasting, and that Member States have a variety of methods to assist the digital switchover, that fits in with EC Treaty state aid rules.

The Commission made clear that it supports the transition to digital broadcasting, and that Member States have a variety of methods to assist the digital switchover, that fits in with EC Treaty state aid rules. Europe could benefit economically and socially, by a concerted approach across Europe to the ‘liberated’ spectrum. The EC wants to see trading in radio wavebands (much championed by the UK regulator OFCOM) and believes that this could assist European firms in launching innovative products and services. A study commissioned by the executive indicated that the move to Digital would have potential benefits of around EUR 9 billion for community members through greater efficiencies.

Europe could benefit economically and socially, by a concerted approach across Europe to the ‘liberated’ spectrum. The EC wants to see trading in radio wavebands (much championed by the UK regulator OFCOM) and believes that this could assist European firms in launching innovative products and services. A study commissioned by the executive indicated that the move to Digital would have potential benefits of around EUR 9 billion for community members through greater efficiencies.